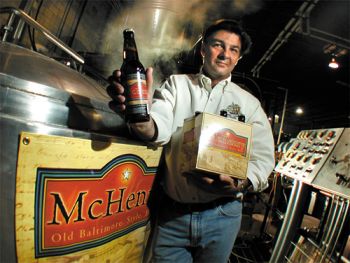

Baltimore Original

Starting

with his eponymously named pub in Baltimore, he has actively

worked in the business since 198O. In the mid-nineteen

eighties, Sisson decided he wanted to add a brewpub to his

restaurant. After determining that Maryland law did not

allow for on-premise brewing, Sisson and others petitioned

the state legislature to change the law. By 1989, Sisson’s

was Maryland’s first brewpub. By 1995, Sisson left the

restaurant business and decided to open the Clipper City

Brewing Company, along with a group of investors. Opened in

December of 1995, Clipper City now brews several successful

lines of ales and lagers, along with a substantial contract

brewing operation. In his free time, Sisson writes his own

blog of the beer industry and has co-hosted a regular radio

program on wine and beer, called Cellar Notes, since

1992.

Clipper City is dedicated

to promoting a broad portfolio of beer at the local level,

especially in its home market. Named for the clipper ship,

first built in the port of Baltimore, the brewery integrates

the region’s nautical and maritime heritage into its

packaging and promotional materials. The brewery now

distributes in eighteen states, including

Massachusetts.

I recently spoke with

him about the Clipper

City brands, freshness dating, and why craft brewers should

be leery of growing too big, too fast.

![]()

ANDY

CROUCH How did you

decide to move from the pub side to the package side of the

beer industry.

HUGH

SISSON There were

two reasons. First, I really enjoyed my run in the

restaurant and pub side – and the place was pretty

successful. The hours are really tough and I wanted to get

into the manufacturing side because I foolishly thought that

was going to simplify my life. The hours are just as long, I

just start a little earlier in the day and end a little

earlier in the evening. So I don’t know that I’ve improved

my quality of life. It’s been an interesting transition. In

my heart of hearts, I’d like to find some way to get another

pub. I underestimated the value of that as a marketing

platform for the brand. That would bring me full

circle.

AC

By my count, Clipper City has three sets of brands.

HS

We do. We have three distinct product groupings or brands.

Part of it was an evolution of our initial business

philosophy. We got started in 1995 to 1996, when the craft

segment of the beer market, which had been experiencing

enormous growth, started to level out. All of a sudden we

found ourselves in a market environment where getting

distribution anywhere outside of your backyard was extremely

difficult. So we were forced to go to a business strategy

where we were going to get local and deep. Everything we did

was focused around being locally named and positioned and in

some ways on more mildly profiled flavor styles. Those

brands have evolved into what we call the Clipper City

brands. There are four brands, BaltoMarzHon, McHenry Lager,

and Clipper City Gold and Pale. The second group is Oxford.

The first microbrewery in the Maryland area was a company

called Oxford Brewing Company. It was built around doing

classic English style beers. I believe their slogan was,

‘American beers with a British accent’. It was started by

two gentleman, one of whom is no longer in the industry. The

other is Steve Parkes, who is now of Otter Creek and

Wolaver’s. That company had its ups and downs. In 1997 or

1998 we acquired them. It’s been developed into a line of

wheat beers, including a raspberry wheat and a hefeweizen.

We’re still looking at changing that branding portfolio.

Four years ago, we felt there was a need to create something

that would allow us to expand our geographic footprint. The

Clipper City products wouldn’t do that, frankly because they

were just so locally positioned it didn’t make sense. There

was probably not much interest from a distributor in Florida

for a beer named for Baltimore. So we created the Heavy Seas

brand with a richer flavor portfolio. It’s targeted at the

real beer aficionados. I probably should have done it two or

three years before I did. That’s worked really well. There

are currently eight beers in that line, with three year

’round and five seasonals.

AC

How are these three sets of brands distributed?

HS

As it stands right now, the Clipper City brands are only in

Maryland, DC and Virginia. We’re pretty much going to stick

with that. The thought process behind that is the Chesapeake

Basin. I don’t think it makes much sense to take them beyond

that. Heavy Seas is currently in eighteen states plus

Washington, DC. Ultimately, we’d like to have it in

twenty-three or twenty-four states and then we’ll probably

stop. We want to make sure we can supply the sales support

and marketing infrastructure, which is critically important.

I think that’s where a lot of people fouled up in the late

nineties. We’re kind of sitting on the Oxford brand for now.

When we finish making our changes, I think we’ll try and put

that in all eighteen states as well.

AC

How has your experience been outside your home market?

HS

Some markets are more challenging than others. The New

England market is at first glance a little more difficult

than if we work south and west. With our North Carolina,

South Carolina and Georgia sale, we’ve been able to get to a

certain sales volume much faster there than in Pennsylvania,

New Jersey, Connecticut, and Massachusetts. I think the

southern markets tend to be more chain driven, while the

northern markets are more independent. And there are plusses

and minuses there. We’re continuing to roll up our sleeves

and adding more staff as we need to provide the level of

support that is requisite in this market

environment.

AC

When did you first enter the Massachusetts market?

HS

We first came into the Massachusetts market about three

years ago. We were relatively short-lived in our first

foray. There was a gentleman we were working with who was

starting his own distributorship and approached us. I think

he made a serious effort but was undercapitalized and it

became evident that it wasn’t going to work. After six or

seven months, we terminated that relationship. It then took

us probably sevent to nine months to figure out who to work

with. We’ve been back in the market for two years

now.

AC

How have your attempts fared in trying to enter the Boston

market?

HS

The Boston market is very, very competitive. There’s an

interesting path that we need to follow. We’re making

inroads but it’s scratching and clawing. There are no slam

dunks in this business. To be successful, you have to get

faucets in on-premise accounts. That’s not the easiest thing

to do. By virtue of fact we’re not local, you’re going to

get out-flanked by your local players. They’ve got the

forces in the market to do it and they should. So you have

to find other ways to get your foot in the door. One way

we’ve tried, though we can’t do it on the scale we’d like,

is that we’ve been bringing up cask-conditioned beers. There

are a small number of high-end beer accounts that if you can

bring them a firkin of cask-conditioned beer, they may give

you a place. That’s a good way to get your foot in the door.

Hopefully you can turn that into a regular

faucet.

AC

Between all the brands, is there a distinct flagship.

HS

Without question, it’s the Loose Cannon Hop3 IPA. That beer

is far and away our best-selling product. It’s part of the

Heavy Seas portfolio. All of the Clipper City brands do

well, but it’s all local. The Heavy Seas brands should do

better by virtue of the fact they are more widely

distributed.

AC

How important is freshness dating?

HS

I think it’s pretty important from the standpoint that it

gives you some credibility with consumers. The only thing

that is tough about it is that quantifying anything in one

simple measurement is typically misleading. For example,

because of the nature of the dark malt in darker beers,

there is a good resistance to oxidation. Dark beers could be

dated a hell of a lot longer than they are. One of the

things that people don’t understand is that the most

delicate beer we make is the Loose Cannon because of all the

hops that are in it. The hop compounds will oxidize quite

quickly and that’s kind of counterintuitive. Many people

think IPAs will wear like iron. Guess what, they’re wrong.

At least doing something that gives the consumer some sort

of criteria in determining whether something is fresh is a

good idea. Anything we can do to give a consumer a way of

determining whether the product is as it should be is

good.

AC

Craft beer has enjoyed substantial growth lately. Where do

you see the craft market going in the next five years?

HS

I think a couple of things. First off, despite what the

major brewers may say, I think it’s pretty well demonstrated

at this stage that craft beer is not a fad. It’s not going

away and it’ll continue to develop. Having said that, I’ve

been in this industry for twenty-five years and things run

in cycles. Right now, we’re in a good cycle. Do I think it

will stay at this level? No. I fully anticipate a slowdown

at some point in time. Then we’ll have a few years where

growth will be difficult to attain and then I think it will

pick up again. That’s just the natural flow of business. I’d

like to see the numbers stay fifteen percent or below

because that’s pretty sustainable growth. The base we’re

working on is still relatively modest. If it drops to seven

and five percent, that is still a real number. If it heats

up to 3O-percent again, like in the late nineties, then the

category starts to overheat. Not to take a Greenspanian

perspective, but I think you have to be aware that it will

attract people who have no business being in the industry

and who are looking for a quick dollar. I think that is what

happened in the early to mid-nineties and why we had a bit

of a Darwinian correction.

AC

The Brewers Association has begun to assert itself more in

the last year, both in promoting craft brewers in

Washington, DC and abroad. It also redefined ‘craft brewer’

to exclude breweries that are owned in part or in full by

larger companies, such as Anheuser-Busch. What are your

thoughts on the politics of this and the renewed interest of

larger breweries in the craft category?

HS

I’m kind of on the fence about this. I don’t think it makes

sense to exclude Goose Island and Widmer or Old Dominion

from what we consider to be craft beers only because of a

business affiliation they have. It was a business move made

to open up distribution and market share and I think that’s

good. Having said that, I’m not thrilled that most consumers

don’t know that Blue Moon is brewed by Coors. I’m not really

sure what Anheuser-Busch is trying to do. I’m not sure that

their involvement is ultimately good for the craft brand

because the people who are interested in what people like me

are doing are not interested in anything Anheuser-Busch. The

Widmer numbers, however, are a good story of success. I

think a lot of this has to do with the maturation of the

industry. This is not hobbyist any more. Even for people

like me for whom this began as a hobbyist venture, this is

what we do. We are professionals in this industry. My fear

is that people become so exclusive that we become beer

snobs. I don’t think that’s beneficial to anybody.